Subcommittees Examine the Export-Import Bank’s Mandates

Washington,

April 30, 2015

The Financial Services Subcommittee on Monetary Policy and Trade and the Oversight and Government Reform Subcommittee on Health Care, Benefits and Administrative Rules held the second in a series of hearings on Thursday on the Export-Import Bank. At Thursday’s hearing, the subcommittees examined the Export-Import Bank’s mandates.

“The Export-Import Bank’s stated goal is to support American jobs through exports. However in my opinion, judging by the Bank’s prior financing deals, it appears to be doing quite the opposite, oftentimes," said Monetary Policy and Trade Subcommittee Chairman Bill Huizenga (R-MI). "American taxpayers have been unwittingly propping up foreign state-owned companies in Saudi Arabia, Russia, China, Venezuela, Pakistan, India, Colombia, Mexico, Ethiopia, South Africa and others who have done nothing but, frankly, work against the best interests of American citizens.”

Key Takeaways From the Hearing:

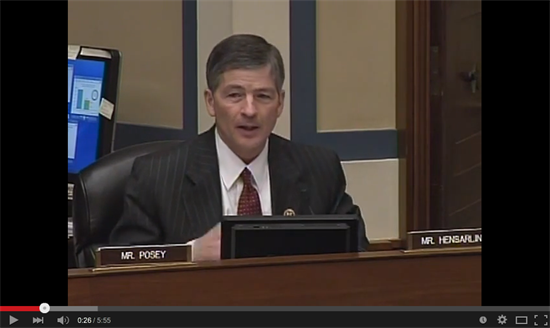

“Since you have taken the helm of Ex-Im, 65 matters have been referred to prosecution, 31 arrest warrants, 85 indictments, 48 criminal judgments, decades of combined prison time, a quarter of billion in fines, restitution and forfeiture,” said Chairman Jeb Hensarling (R-TX).

|