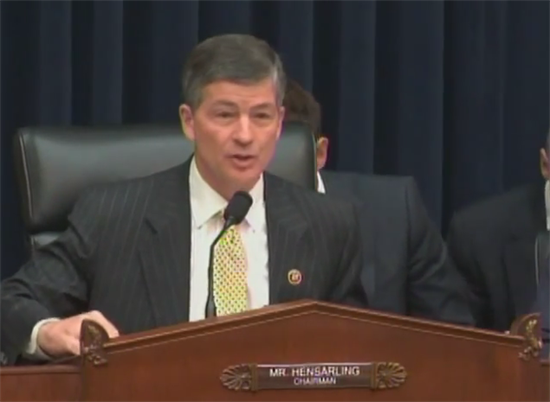

Hensarling Calls for More Transparent and Accountable Federal Reserve

Washington,

July 15, 2015

Tags:

Federal Reserve Reform

WASHINGTON- Financial Services Committee Chairman Jeb Hensarling delivered the following opening statement at today’s Full Committee hearing with Federal Reserve Chair Janet Yellen: Last week this committee began a series of hearings examining the Dodd-Frank Act on its fifth anniversary; an act which vastly expanded the powers and reach of the Federal Reserve beyond its traditional monetary policy role in historically unprecedented ways. The evidence continues to mount that since the passage of Dodd-Frank, our nation is less stable, less prosperous, and less free. We continue to be mired in lackluster, halting economic growth. Middle income paychecks are nearly $12,000 less compared to the average post-war recovery. And as the Ranking Member Ms. Waters told us just a few months ago, “the brutal truth is millions continue to teeter on the brink of poverty and collapse.” One way our economy could be healthier is for the Federal Reserve to be more predictable in the conduct of monetary policy. During periods of expanded economic growth like the Great Moderation of 1987-2003, the Fed followed a more clearly communicated, understandable, and predictable convention or rule. America prospered. Today we’re left with so-called “forward guidance,” which unfortunately remains somewhat amorphous, opaque, and improvisational. Too often, this leads to investors and consumers being lost in a rather hazy mist as they attempt to plan their economic futures and create a healthier economy for themselves and for us all. As one former Fed President has written, “Monetary policy uncertainty creates inefficiency in the capital market. The FOMC gives lip service to policy predictability but its statements are vague…The FOMC preaches that policy is data dependent but will not tell us what data and how.” Following a monetary policy convention or rule of the Fed’s own choosing with the power to amend it or deviate from it at the Fed’s own choosing in no way interferes with the Fed’s monetary policy independence. Accountability and independence are not mutually exclusive concepts. Next, we in Congress would be grossly be negligent if we do not engage in greater oversight of the Federal Reserve System. Again, Dodd-Frank confers sweeping new powers on the Fed to regulate and control virtually every corner of the financial services sector of our economy, completely separate and apart from its traditional monetary policy role. Yet too often, the Fed appears to shield these activates from public view and improperly cloaking them behind monetary policy independence. Second, the Fed has now employed historically unprecedented methods – from intervening to prop up select credit markets, to paying interest on excess reserves, to keeping interest rates near zero for almost seven years. By doing so the Fed has certainly blurred the lines between fiscal and monetary policy. Finally, the Fed has recently crossed the line by willfully ignoring a lawful congressional subpoena for documents. This is inexcusable and unsupported by legal precedence. It cannot be allowed to stand. The Fed’s refusal to cooperate in a Congressional investigation threatens both its reputation and its credibility. The Fed is not above the law. This is a very serious matter and must be resolved. ### |