It was too good to last forever.

For most of 2013, the effortless stride of the US stock market has coaxed more and more investors—both retail and pros—into stocks. Before yesterday’s stumble, US stocks were up about 17% year-to-date, making them one of the best-performing asset classes in the world.

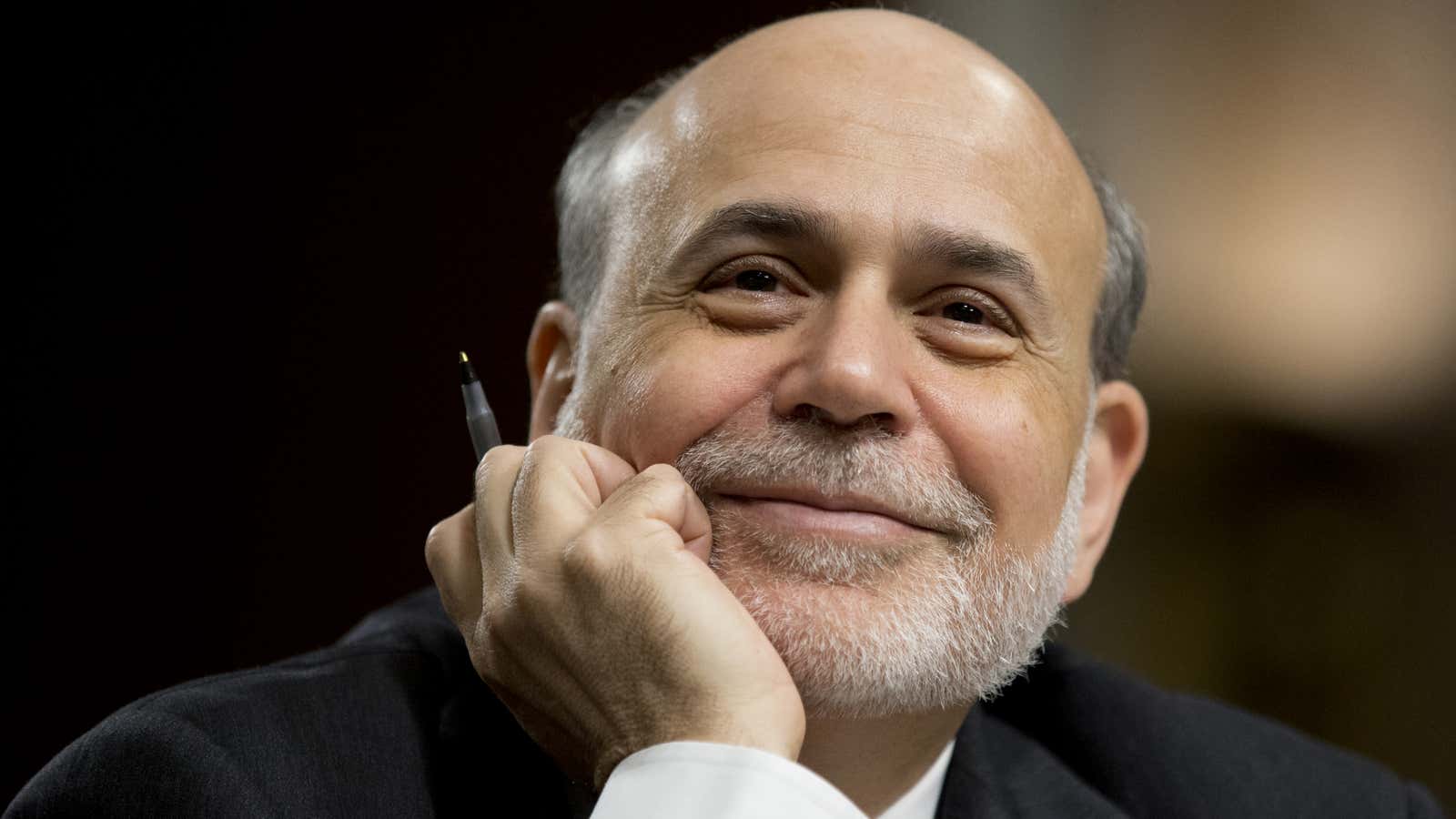

And then Federal Reserve chairman Ben Bernanke had to go and upset the apple cart by uttering five little words : “In the next few meetings.”

That’s what the former Princeton professor said when Congressional inquisitors prodded him on how soon the Fed might scale back its current quantitative easing program, in which it buys some $85 billion in Treasury bonds and government backed packages of mortgages each month. Here’s the key exchange between Texas Republican representative Kevin Brady and Bernanke (emphasis mine):

BRADY: When do you expect this strategy to begin? What are the benchmarks you’re looking at to begin this process?

BERNANKE: We are looking at — we’re trying to make an assessment of whether or not we have seen real and sustainable process in the labor market outlook.

And this is a judgment that the committee will have to make. If we see continued improvement and we have confidence that that is going to be sustained, then we could in — in the next few meetings, we could take a step down in our pace of purchases. Again, if we do that, it would not mean that we are automatically aiming toward — toward a complete wind-down. Rather, we would be looking to beyond that to see how the economy evolves, and we could either raise or lower our pace of purchases going forward.

Again, that is dependent on the data. If the outlook for the labor market improves and we are convinced that that is sustainable, we will respond to that. If the recovery were to falter, if inflation were to fall further and we felt that the current level of monetary accommodation was still appropriate, then we would delay that process.

Why are those little words such a big deal? For a couple of reasons. First, for as long as Bernanke has been peppered with questions about his plans to move away from his bond-buying policies, he’s almost always backhanded them away by saying it’s a question of how the economic data come in. The fact that the economic data he chose to emphasize this time were data about jobs, which have been improving of late, rather than other data that have been more uneven—such as inflation, which is still below where the Fed traditionally likes it—and that he then put a relatively specific timeframe (“the next few meetings”) on when the Fed might start to act on those data, is significant. Add that to the fact that all this emerged in Bernanke’s very first reply during the question-and-answer session, and it makes Fed watchers suspect that it was a very deliberate effort to get a message across: We’re near the faintest beginnings of a turn away from the super-easy monetary policy which has prevailed since the credit crisis.

Now it’s important to remember that the Fed wouldn’t be talking this way if it didn’t feel pretty good about how the economy looks. And this morning’s improvement in weekly jobless claims suggests the biceps of the labor market are starting to bulge a bit more. But as we all know, the economy and the financial markets don’t mirror each other perfectly. A lot of economic optimism has already been expressed in the rise of the stock market. Investors may now greet continued tangible evidence of economic improvement a little differently, if they know it means the Fed might start take the training wheels off the economy.