|

| CLICK HERE TO WATCH |

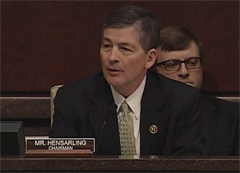

Financial Services Committee Chairman Jeb Hensarling (R-TX) delivered the following opening statement at today’s full committee hearing with Housing and Urban Development Secretary Julian Castro:

Last year I think we all know was the 50th anniversary of the “War on Poverty” and 50 years later and $20 trillion later unfortunately 15 percent of our fellow Americans remain at the poverty level. So it’s hard to judge the “War on Poverty” as a success and perhaps the bigger failure is not to live up to President Johnson’s goal “not only to relieve the symptom of poverty but to cure it and above all to prevent it.”

Arguably one of the most important weapons in the “War on Poverty” has been HUD with its many programs and its many employees and this year is the 50th anniversary of HUD. So I wish to announce to all Members that this committee will take an extensive review and thorough examination of the successes and failures of HUD. And not just measure inputs but measure the outputs as well and most importantly, again to paraphrase President Johnson, to find out how these programs can be designed to lift people from lives of poverty, lives of government dependency and lift them to the dignity of work and self-sufficiency. I look forward to working with you, Mr. Secretary, on this examination and exploring various avenues where we can work together.

Now to today’s hearing. This is the second part examining what appears to many to be an administration’s taxpayer-funded “race to the bottom” to become the nation’s largest subprime lender. Whether FHA or FHFA wins that contest, I know that the marginal homebuyer on the bubble and the poor, beleaguered taxpayer- they will certainly be the losers in this race.

We all recall the famous admonition from Spanish philosopher Santayana who said “those who do not remember the past are condemned to repeat it.” History has taught us that the root cause of the financial crisis was not deregulation but dumb regulation and helping put people into homes they could not afford to keep.

Now the FHA with exceedingly low down payments and a recently announced approximately 40 percent cut in its premiums appears to be doing that. All at a time where the FHA continues to violate federal law by keeping a woefully insufficient capital reserve and right after receiving its first ever taxpayer bailout. This cannot be allowed to stand.

Now with respect to subprime lending, what consenting adults do with their money is their business. But what FHA does with taxpayer money is our business. Do we really want the federal government to be leading the charge into subprime lending? We’ve all heard from our constituents. I heard from a gentleman, Walter, from Mesquite: “I am one of those that got a house I never should have gotten. I could not afford to buy a home but no one told me that. Now I’m behind and underwater on a house I never should have bought.” Again, the administration should not be leading the way, putting people like Walter into homes they cannot afford to keep.

We need a sustainable housing policy. Sustainable for homeowners, sustainable for taxpayers, and sustainable for our economy. The best program of affordable housing is a growing and healthy economy built from Main Street up, not built from Washington down.