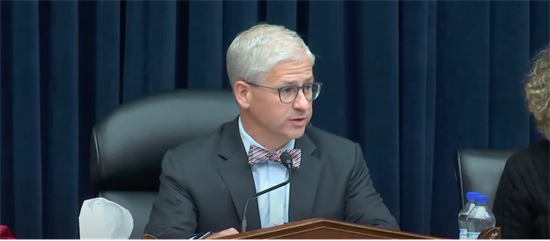

Today, the House Financial Services Committee, led by Chairman Patrick McHenry (NC-10), held its first bipartisan hearing to examine the recent failures of Silicon Valley Bank and Signature Bank. At the hearing, Republicans demanded answers from the U.S. Treasury Department, Federal Reserve Board, and Federal Deposit Insurance Corporation to ensure accountability and transparency by decision-makers.

Chairman McHenry grilled the witnesses about what they knew about the Silicon Valley Bank and Signature Bank failures and when. The Chairman also demanded the regulators provide information regarding their decision to invoke the systemic risk exception to cover uninsured deposits at the failed banks.

Watch Chairman McHenry’s questioning here or by clicking the image above.

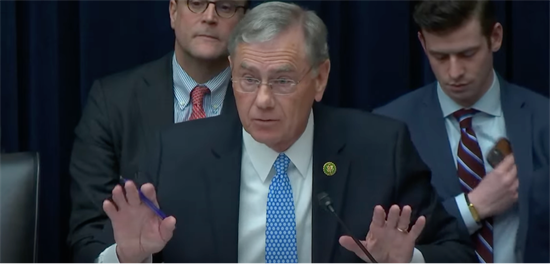

Committee Vice Chairman French Hill (AR-02) demanded regulators own up to their lack of supervisory attention surrounding the bank failures. Vice Chair Hill criticized the Administration’s failure to fill the role of Vice Chair for Supervision at the Federal Reserve in the months leading up to Silicon Valley Bank’s collapse and demanded accountability for regulators’ lack of urgency following the bank failures.

Watch Vice Chairman Hill’s questioning here or by clicking the image above.

Subcommittee on National Security, Illicit Finance, and International Financial Institutions Chair Blaine Luetkemeyer (MO-03) questioned the calls for legislative action and further regulation of the banking system. Chair Luetkemeyer called on regulators to enforce existing rules before looking to Congress to legislate new ones.

Watch Subcommittee Chairman Luetkemeyer’s questioning here or by clicking the image above.

Subcommittee on Oversight and Investigations Chair Bill Huizenga (MI-04) slammed witnesses on regulators’ lack of transparency following the collapse of SVB and Signature Bank. Chair Huizenga specifically noted the secrecy surrounding the FSOC meetings at which Signature Bank’s failure was deemed a “systemic risk” and demanded that those unredacted minutes be made available to the public.

Watch Subcommittee Chairman Huizenga’s questioning here or by clicking the image above.

###