financialservices.house.gov

Cmte Financial Services (R)

Contact:

House Passes Slate of Bipartisan Financial Services Legislation to Strengthen U.S. National Security

Washington,

January 12, 2024

-

Today, the U.S. House of Representatives passed five pieces of bipartisan financial services legislation to bolster our national security by confronting the generational economic threat posed by the Chinese Communist Party’s (CCP), combatting terrorism financing, and decreasing global reliance on Russian agriculture exports.

The financial services bills passed by the House include:

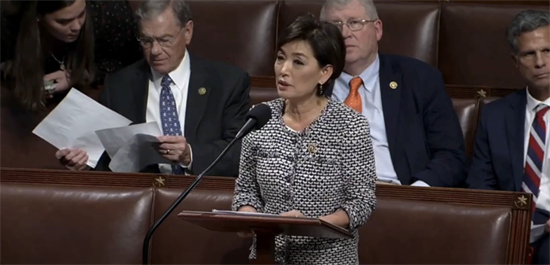

H.R. 540, the “Taiwan Non-Discrimination Act of 2023,” sponsored by Rep. Young Kim (CA-40), will require the U.S. to advocate for Taiwan's membership at the International Monetary Fund.

Watch Rep. Kim’s remarks on the House Floor in support of H.R. 540 here or by clicking the image above.

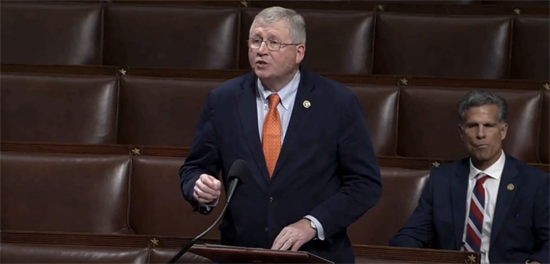

H.R. 803, the “PROTECT Taiwan Act,” sponsored by Rep. Frank Lucas (OK-03), will help isolate the CCP from the international financial system by directing the Federal Reserve, the Secretary of Treasury, and the Securities and Exchange Commission to exclude representatives from the People’s Republic of China from proceedings of various international financial groups and organizations in the event of an invasion of Taiwan.

Watch Rep. Lucas’s remarks on the House Floor in support of H.R. 803 here or by clicking the image above.

H.R. 839, the “China Exchange Rate Transparency Act of 2023,” sponsored by Rep. Dan Meuser (PA-09), will protect global market participants from the CCP’s exploitative practices by requiring the U.S. Director at the International Monetary Fund to advocate for greater transparency in China’s disclosure of its exchange rate policies.

Watch Rep. Meuser’s remarks on the House Floor in support of H.R. 839 here or by clicking the image above.

H.R. 6370, the "OFAC Licensure for Investigators Act," offered by Rep. Joyce Beatty (OH-03), requires the Secretary of the Treasury to develop a pilot program within the Office of Terrorism and Financial Intelligence (TFI) and administered by the Office of Foreign Assets Control (OFAC), to allow private-sector firms to conduct nominal financial transactions with sanctioned entities in furtherance of investigations. The program includes regular reporting of the licensed recipients’ findings to OFAC as a condition of the license.

H.R. 4768, the “No Russian Agriculture Act,” offered by Rep. Maxine Waters (CA-43), directs the U.S. Executive Directors of the International Financial Institutions to use its voice, vote, and influence to encourage the International Financial Institutions to invest in projects that decrease reliance on Russia for agricultural commodities.

###