Dodd-Frank Rules Will Crush Employment

Washington,

December 13, 2011

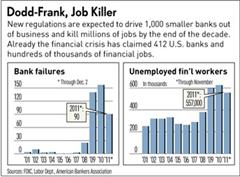

By Paul Sperry, for Investor’s Business Daily Job-killing bank regulations threaten to wipe out all the gains in private-sector employment since the recovery began, the industry warns. Washington, however, is hiring thousands more bureaucrats to enforce the rules.

Signed into law last year, the Dodd-Frank Act is the biggest rewrite of financial regulations since the New Deal. It was intended to rein in Wall Street "excesses." But the banking industry says burdensome red tape is hurting economic growth and jobs in a still-sluggish labor market. "The level of real GDP could be 2.7% less by the year 2015 than would otherwise be the case for the United States," said Stephen Wilson, outgoing chairman of the American Bankers Association. "This could result in 2.9 million fewer jobs being created.” By comparison, the economy has created 1.78 million private jobs since the recovery officially began in June 2009. Wilson says Dodd-Frank has resulted in more than 5,230 pages of proposed and final rules, which laid end-to-end would exceed the height of New York's Empire State Building — five times over. Only a fourth of the rules have gone into effect so far, he says; yet the law in its first year has already imposed almost 20 million hours of paperwork on U.S. businesses. It took an estimated 5.5 million man-hours, in contrast, to build every iPhone sold. Dodd-Frank compliance costs for the financial industry already top $12 billion. That is expected to swell as the remaining 77% of required rules are finalized. Also, price controls imposed by Dodd-Frank will result in a 45% loss in debit card interchange revenue for banks, Wilson pointed out. Banks have laid off workers to raise revenue to meet higher capital reserves mandated under the law. "In the end," he said, "it means fewer loans get made, slower job growth and a weaker economy. Wilson, who also runs a small bank in Ohio, made the remarks last month during a speech on international finance in Tokyo. The new regulatory regime, however, is a boon for lawyers and government workers. A Government Accountability Office study this summer concluded that implementing Dodd-Frank rules would require 2,850 additional federal employees just through fiscal 2012 (which ends Sept. 30) — at a cost to taxpayers of $1.3 billion. The Consumer Financial Protection Bureau will command the bulk of new hires and funding. Created by Dodd-Frank, the watchdog agency started with a staff of 1,225 and a budget of $330 million. Patrice Ficklin, who heads CFPB's Office of Fair Lending, says she's hiring lawyers, statisticians, analysts and enforcement agents. These are high-paying jobs. In fact, the CFPB has hired at least a dozen employees at salaries of more than $225,000 a year. The White House denies the financial regulations it championed are costing companies revenue and slowing hiring. It cites, for example, higher corporate profits. "If you look at corporate profits, it's hard to make the case that regulations have caused companies to be scared about (hiring) or (that they're) hurting their job growth," argued Alan Krueger, President Obama's top economist. "I think the main reason (for weak hiring) is that the companies feel that they could satisfy the demand that they face with the workers that they have," Krueger added in a recent CNBC interview. "Until they are more confident that consumers are coming back at a greater clip — that the demand will be there — I think we'll continue to see job growth at the kind of moderate pace that we've seen. But analysts note that hiring still lags consumer spending. And they say profits are up mainly because businesses have slashed payrolls and other costs. Even Rep. Barney Frank, D-Mass., admits the regulation he co-sponsored has cost jobs in the financial sector. But he says it's a "reasonable price" to pay to bring "greedy" bankers to heel. "If you lock up drug dealers," he said in a recent interview, "you're going to have fewer jobs. U.S. Chamber of Commerce official David Hirschmann says employers remain uneasy about Dodd-Frank. "Instead of creating jobs, the law has created uncertainty for job creators," he said. "The economic statistics bear that out. Hirschmann added: "We are simply not going to see American companies spending capital until they can begin to navigate their way through this tangled web of regulation. Dodd-Frank Hits Small Firms By forcing banks to increase the capital they have on hand to cover losses, Dodd-Frank has reduced capital available for small-business loans. This in turn has slowed hiring. Tom Boyle of State Bank of Countryside in La Grange, Ill., says Dodd-Frank is "handicapping our ability to meet the credit needs" of small firms. "The consequences are real," Boyle said. "It means fewer loans get made. It means slower job growth. Product marketer K&M of VA Inc., for one, wanted to expand this year but for the first time had trouble getting a line of credit. Owner Mike Bucci blames the new bank law. So does American Business Group, an Orlando, Fla.-based company that matches small-business buyers and sellers. If buyers can't access a loan thanks to Dodd-Frank, CEO Jessica Hadler Baines told IBD, "then the other option is to close the business down, putting more workers into unemployment. The credit crunch could worsen if Dodd-Frank drives smaller banks out of business as predicted. "Dodd-Frank and the related burdens are threatening not just our industry but our very banks," ABA's Wilson said. "The most conservative estimates predict that by the end of the decade, there will be 1,000 fewer banks in the United States. That means fewer financial jobs in a sector that has already lost hundreds of thousands of workers. |