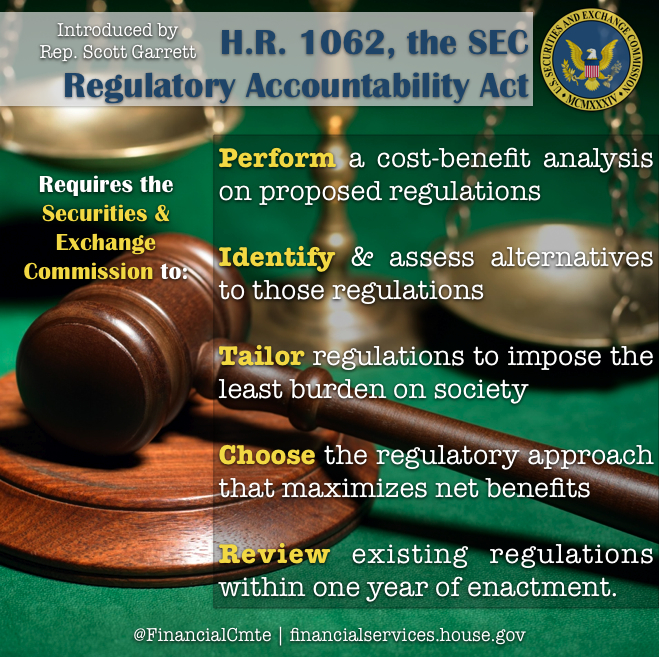

Requiring Regulatory Accountability at the SEC

Washington,

May 13, 2013

Problem: As an independent agency, the Securities and Exchange Commission (SEC) is not currently subject to President Obama’s Executive Order No. 13563. The order directs non-independent executive branch agencies to perform a cost-benefit analysis on proposed regulations, tailor those regulations to impose the least burden on society, and retrospectively analyze old rules to identify those ripe for repeal. Example: Last year, the U.S. Court of Appeals for the DC Circuit unanimously concluded that in promulgating a rule related to corporate board elections, the SEC “inconsistently and opportunistically framed the costs and benefits of the rule; failed to adequately quantify the certain costs or to explain why those costs could not be quantified; neglected to support its predictive judgments; contradicted itself; and failed to respond to substantial problems raised by commenters.” Solution: H.R. 1062 would essentially codify President Obama’s E.O. No. 13563 with regard to the SEC. It would require the SEC to:

|