HUD IG: Department’s Eight Year Delay Impacts FHA Fund by $15 Billion

Washington,

September 17, 2013

Last week, the Oversight and Investigations Subcommittee questioned the Department of Housing and Urban Development's (HUD) Inspector General, David Montoya, about reducing waste, fraud, and abuse in the department’s housing programs. All totaled, the latest IG report identified more than $770 million in questionable costs and included recommendations for putting $739.5 million in HUD funds to better use.

In the above exchange with Rep. Ann Wagner, however, the IG raised another concern: the egregious length of time it takes HUD to implement audit findings. In one case related to now largely prohibited seller-funded downpayment assistance, Mr. Montoya said HUD delayed implementation of IG recommendations for nearly a decade, impacting the Federal Housing Administration’s (FHA) Mutual Mortgage Insurance (MMI) Fund on the order of $15 billion.

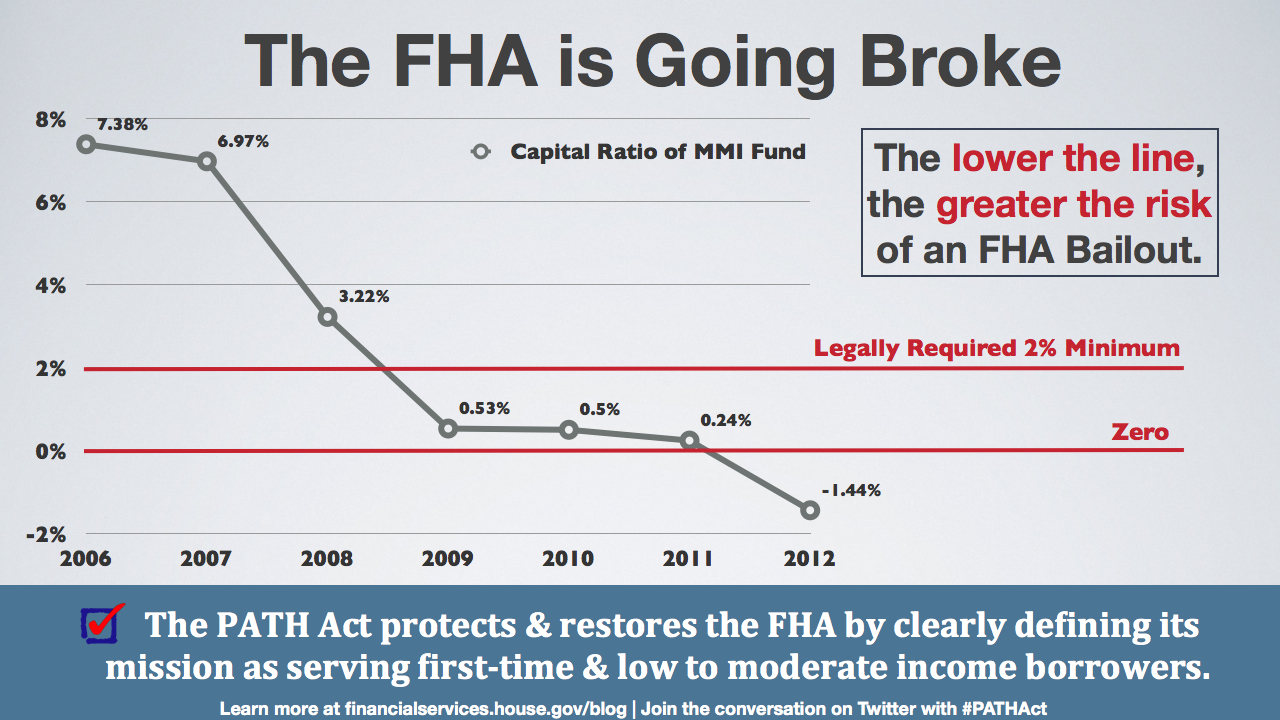

The MMI Fund (the “fund” as Mr. Montoya calls it in the clip) is at the center of the FHA’s business, backing more than $1 trillion worth of home mortgages on behalf of American taxpayers. An actuarial report released by HUD in November 2012 revealed the MMI Fund had a negative economic value of $16.3 billion, dropping the fund’s capital ratio – a measure of the fund’s health – below the 2 percent minimum required by law. That decline in the health of the MMI Fund also prompted the Government Accountability Office (GAO) to add FHA to its list of "high risk" government programs earlier this year.

This level of waste, fraud, and abuse at HUD reinforces everything our committee has been saying about the FHA for some time now – it is a high risk to taxpayers, it is a high risk to the mortgage insurance market and it represents a high risk to our economy. That's why reforming the FHA is a critical step in the path to a sustainable housing finance system. Toward this end, the PATH Act would make FHA operate more like a private mortgage insurer, requiring it to issue quarterly financial reports based on Generally Accepted Accounting Principles (GAAP), and maintain a capital reserve ratio of at least 4 percent – up from the 2 percent currently required. |