This Halloween, Watch Out For Those Who Are Trying to Trick You About the PATH Act!

Washington,

October 31, 2013

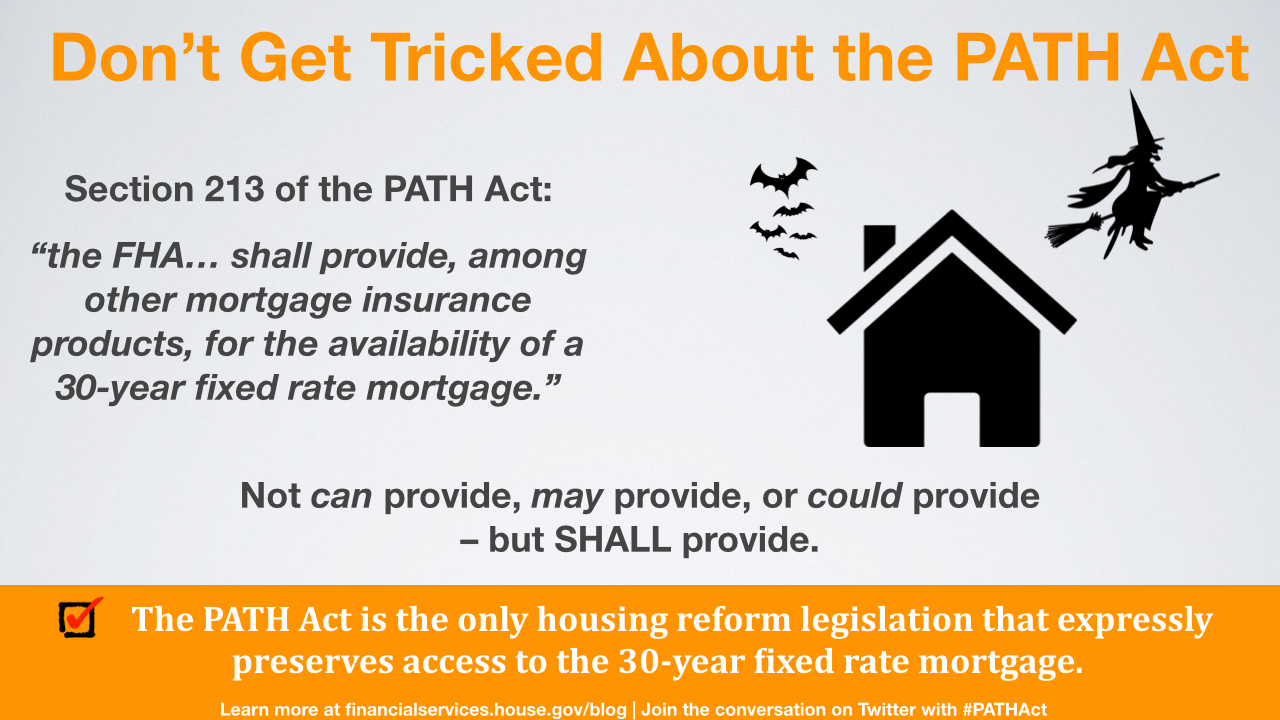

The Protecting American Taxpayers and Homeowners Act – the PATH Act – expressly preserves the 30-year fixed rate mortgage. In fact, it's the only housing reform bill that specifically does so. But those who defend the status quo are trying to trick you into believing otherwise.

If it becomes law, the PATH Act would mark the first time that the FHA is specifically required to offer a 30-year fixed rate insurance product. Moreover, many have said the very existence of the 30-year fixed rate mortgage is due to the creation of the FHA. If that's the case, the PATH Act goes to great lengths to strengthen the 30-year fixed rate mortgage by taking FHA out of HUD and making it its own autonomous, stand-alone agency. This new FHA would have the tools and flexibility it needs to fulfill its mission in a financially sound manner.

Still spooked? Consider this: The 30-year fixed rate mortgages existed before the financial crisis and they are being made today without a government guarantee.

As the Washington Post recently stated in an editorial: “Opponents of the PATH Act argue that the lack of permanent government backing will deprive the market of liquidity and consequently end the 30-year fixed rate mortgage…One answer to that is that some 30-year fixed rate loans already exist without government help…”

Homebuyers should have the opportunity to acquire a 30-year fixed rate mortgage. They do today. And the PATH Act will not change that.

|