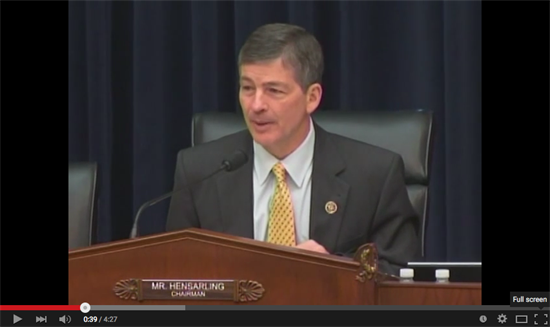

Hensarling Highlights Real Help for Small Businesses“You can’t have more and better jobs without more and better capital formation”

Washington,

May 20, 2015

I believe that it was last quarter that the economy showed something that was less than sub-par and less than anemic and that was showing barely a pulse of .2 economic growth. I don’t want to read too much into one quarter’s GDP growth but regrettably we still seem to be mired in the longest, slowest recovery in the post-war era. We still have millions and millions of our fellow countrymen, hardworking moderate-incoming taxpayers, who find themselves with stagnant to lower paychecks; bank accounts that are less than before the great economic crisis -- and they need more jobs, better jobs, and you can’t have more and better jobs without more and better capital formation. So we have 13 bills before us today; the vast majority of which I think, with the exception of two, are all bipartisan. I think with the exception of two all were seen in the last Congress and each and every one I believe passed either unanimously or with an overwhelming bipartisan vote. I hope they will receive the same fate today. Time will tell. But we know that our small companies and startups continue to suffer and that is why one bright note has been the JOBS Act. Even though regrettably the SEC has taken their sweet time about acting on the rulemaking as those rules were promulgated we saw increased IPO activity. We saw some increased startups which is so vital because our entrepreneurial activity remains at a generational low. It is our small business -- we all know this, we know it anecdotally, we know it statistically -- but it is our small businesses that continue to be the job engine in America. But regrettably a lot of the regulatory scheme has been made for larger financial companies and put an undue burden on smaller startups and our smaller companies. We must remember that the SEC, part of their three-part mission is capital formation. We should not as a United States Congress totally outsource that vital function of our economy to the SEC because regrettably they have occasionally dragged their feet on this. That is something that has been recognized on both sides of the aisle. Thus, a number of these provisions, almost all of which are quite modest, some I believe are simply clarifications of drafting errors or oversights. So to some extent, I think I would view a number of these bills as simply helping level the playing field between our larger companies and our smaller companies -- larger financial concerns and smaller financial concerns. So I’m hopeful. Again, most of these bills were designed for bipartisan support. It certainly doesn’t do everything I would like to see in the space of capital formation. But it remains our goal to try where we can to work on a bipartisan basis to try to get bills on the president’s desk that he could sign. And I hope again that the anemic pace of entrepreneurial activity and capital formation for the startups remains a bipartisan concern that hopefully can be addressed this morning. |