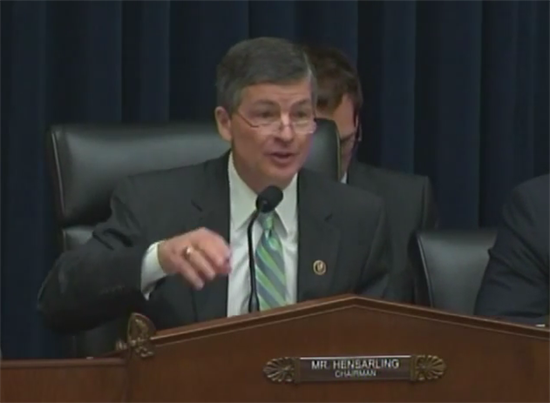

Hensarling: “Hardworking Americans deserve better than Dodd-Frank”“The painful truth is that Dodd-Frank and the hyper-regulated Obama economy are failing low- and moderate income Americans who simply want their fair shot at economic opportunity and financial security.”

Washington,

July 28, 2015

Under the Obama economic strategy of which Dodd-Frank is a central pillar, our anemic recovery has created 12.1 million fewer jobs than the average recovery since World War II. For more than a year now, the share of able-bodied Americans in the labor force has hovered at the lowest level in nearly 40 years. Small business startups are at the lowest level in a generation. Had this recovery simply been as strong as average previous ones, middle income families would have nearly $12,000 more in annual income, and 1.6 million more of our fellow Americans would have escaped poverty. This is simply unacceptable. But more than numbers, my constituents’ angst tells me all I need to know. One wrote me not long ago: “There are part time jobs around my area…but always jobs with no benefits and less than 40 hours…My son is a disabled Iraqi Freedom combat veteran who has lost hope of a decent full time job.” I suspect most Members of Congress unfortunately still receive letters like these. The painful truth is that Dodd-Frank and the hyper-regulated Obama economy are failing low- and moderate income Americans who simply want their fair shot at economic opportunity and financial security. As we know, a recent Federal Reserve report states that within a few years roughly one-third of black and Hispanic borrowers may find themselves disqualified from obtaining a mortgage to buy a home because of Dodd-Frank’s “Qualified Mortgage” rule based solely on its rigid debt-to-income requirements. Because of Dodd-Frank, free checking at banks has been cut in half. Furthermore, according to the FDIC, more than 9 million households don’t have a checking or savings account, principally because account fees are too high or unpredictable, another consequence of Dodd-Frank. Dodd-Frank’s 2,300 pages launched a salvo of consequences that have crippled growth. It was advertised to target Wall Street but has instead clearly hit Main Street. It has had pernicious effects on small businesses and community financial institutions which are the lifeblood of the Main Street economy. Community banks and credit unions supply the bulk of small business and agricultural loans, but the combined weight of Dodd-Frank’s 400 regulations is dragging them down. We are losing on average one community financial institution a day. But Dodd-Frank goes far beyond banks and credit unions. Its corporate governance provisions hit every public company in America. Grocery markets, cable TV servers, and bowling alley chains did not cause the financial meltdown but still must comply with regulations imposing wage controls, salary ratios, and private compensation disclosures made for big Wall Street firms. Every dollar these businesses are forced to spend on hiring lawyers and accountants to explain this gibberish is taken out of working peoples’ wages and capital expansion. No wonder the economy limps along at two percent GDP growth, far below its historic norm. No wonder low- and moderate-income Americans lose sleep at night worrying about their stagnant wages, smaller bank accounts, and children’s future. Hardworking Americans deserve better than Dodd-Frank.

### |