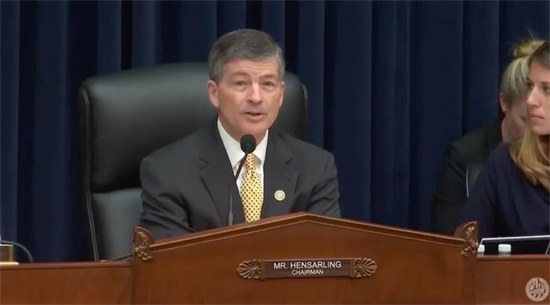

Chairman Hensarling Statement on Proposed Volcker Rule Changes

Washington,

May 31, 2018

House Financial Services Committee Chairman Jeb Hensarling (R-TX) released the following statement today after the Federal Reserve proposed to revise the Volcker Rule that heavily impacted markets, businesses, investors, and job creators. "Nonetheless, I take Federal Reserve Vice Chairman for Supervision Randy Quarles at his word that today’s proposal 'is not the completion of our work,' and I look forward to the regulators’ future efforts to fix the needless complexities of the Volcker Rule that have chilled market making and increased costs for Main Street. In the meantime, the House has already acted to streamline the Volcker Rule’s burdens and complexities by passing H.R. 4790, the 'Volcker Rule Regulatory Harmonization Act,' bipartisan legislation sponsored by Representative French Hill (R-AR) and cosponsored by Representative Bill Foster (D-IL). The Senate should follow the strong 300-104 bipartisan vote and work with the House to see this bipartisan bill become law.” |