House Financial Services Committee Reports Regulatory Oversight, Capital Formation Legislation to Full House for Consideration

Washington,

May 24, 2023

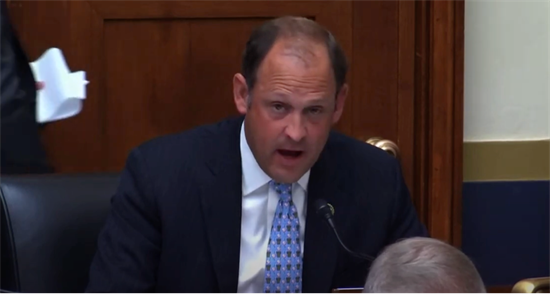

Today, the House Financial Services Committee passed several pieces of legislation out of Committee—many of which received bipartisan support—that advance Republicans’ capital formation agenda, increase accountability and transparency for financial regulators following recent bank failures, and reverse the Federal Housing Finance Agency’s disastrous recalibrated single-family mortgage pricing framework. More information on all 6 bills reported out of the Financial Services Committee can be found below including Member remarks in support of their legislation: H.R. 3556, the “Increasing Financial Regulatory Accountability and Transparency Act,” sponsored by Rep. Andy Barr (KY-06), will ensure that banking regulators are acting within the authorities provided by Congress by bolstering accountability and transparency at the agencies, especially in the event they invoke emergency powers. Watch Rep. Barr’s remarks in support of H.R.3556 here or by clicking the image above. H.R. 3564, the “Middle Class Borrower Protection Act,” sponsored by Rep. Warren Davidson (OH-08), rescinds the Federal Housing Finance Agency’s recalibrated single-family mortgage pricing framework that forces borrowers with good credit to subsidize riskier loans and takes steps to ensure similar changes cannot be made in the future. Watch Rep. Davidson’s remarks in support of H.R. 3564 here or by clicking the image above. H.R. 2627, the “Increasing Investor Opportunities Act,” sponsored by Rep. Ann Wagner (MO-02), would lift the arbitrary limit on the amount of assets a closed-end fund may invest in private funds, affording everyday investors greater choice and providing them the opportunity to gain diversified exposure to an asset class that they otherwise could not attain. Watch Rep. Wagner’s remarks in support of H.R. 2627 here or by clicking the image above. H.R. 1553, the “Helping Angels Lead Our Startups (HALOS) Act,” sponsored by Rep. Mike Lawler (NY-17), would codify provisions finalized in SEC Rule 148, ensuring that issuers of new securities may continue to conduct “demo days” to discuss their products and business plans without such discussions being considered an investment offering in violation of securities laws. Watch Rep. Lawler’s remarks in support of H.R. 1553 here or by clicking the image above. H.R. 2622, the “a bill to amend the Investment Advisers Act of 1940 to codify certain Securities and Exchange Commission no-action letters that exclude brokers and dealers compensated for certain research services from the definition of investment adviser, and for other purposes,” sponsored by Rep. Pete Sessions (TX-17), would strengthen American capital markets by providing U.S. broker-dealers relief from MiFID II regulation, preventing a reduction in investment research that would harm investment managers and the retail investor customers they serve. Mr. Gottheimer (NJ-05) offered an amendment to the amendment in the nature of a substitute, which was adopted. Watch Rep. Sessions’ remarks in support of H.R. 2622 here or by clicking the image above. H.R. 3063, the “Retirement Fairness for Charities and Educational Institutions Act,” sponsored by Rep. Frank Lucas (OK-03), would allow employees of non-profit charities and public educational institutions in 403(b) plans to have access to the same low-cost investments available to employees of for-profit companies and other employers in 401(k) plans. Watch Rep. Lucas’ remarks in support of H.R. 3063 here or by clicking the image above. ### |