House Passes Additional Slate of Bipartisan Financial Services Capital Formation Legislation

Washington,

June 5, 2023

This week, the U.S. House of Representatives passed seven pieces of bipartisan financial services legislation to facilitate capital formation by strengthening public markets, helping small businesses and entrepreneurs, and creating opportunities for all investors. This builds on the four pieces of bipartisan capital formation legislation passed last week.

The financial services bills passed by the House include:

Watch Rep. Hill’s remarks on the House Floor in support of H.R. 835 here or by clicking the image above.

H.R. 1579, the Accredited Investor Definition Review Act, sponsored by Rep. Bill Huizenga (MI-04), updates the list of certifications that an investor must satisfy to qualify as an accredited investor to ensure that more Americans have an opportunity to participate in the growth and success of our economy.

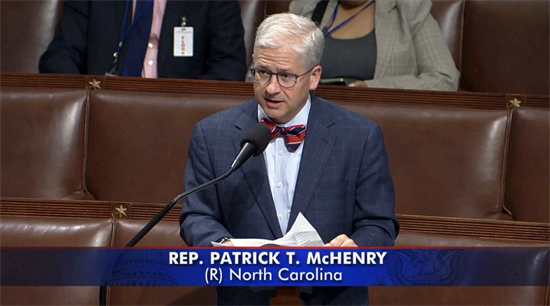

H.R. 2608, a bill to amend the Federal securities laws to specify the periods for which financial statements are required to be provided by an emerging growth company, and for other purposes, sponsored by Chairman Patrick McHenry (NC-10), clarifies that the scaled financial reporting obligations for an “Emerging Growth Company (EGC)” enacted by the JOBS Act of 2012 remain available both when an EGC acquires another company and in follow-on offerings for a company that lost its EGC status during IPO registration, which will eliminate an irregularity in the law’s application and will increase the attractiveness of going public for smaller companies.

Watch Chairman McHenry’s remarks on the House Floor in support of H.R. 2608 here or by clicking the image above.

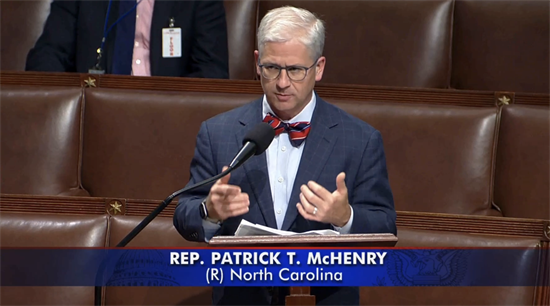

H.R. 2610, a bill to amend the Securities Exchange Act of 1934 to specify certain registration statement contents for emerging growth companies, to permit issuers to file draft registration statements with the Securities and Exchange Commission for confidential review, and for other purposes, sponsored by Chairman McHenry, would equalize the “Emerging Growth Company (EGC)” financial statement accommodations enacted under the JOBS Act of 2012 whether an EGC is conducting an IPO or spinning off a portion of its business and taking that company public, thereby facilitating efficiency and capital formation without sacrificing investor protection.

Watch Chairman McHenry’s remarks on the House Floor in support of H.R. 2610 here or by clicking the image above.

H.R. 2593, the Senior Security Act of 2023, sponsored by Rep. Josh Gottheimer (NJ-05), would create a task force to protect seniors from falling victim to fraud and abuse in our capital markets.

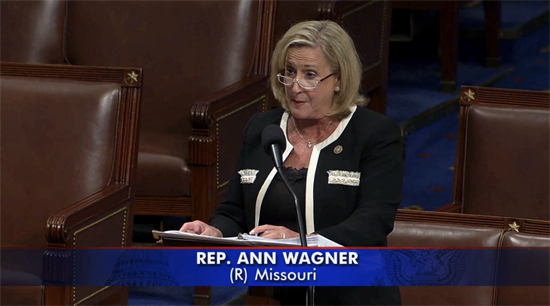

H.R. 2793, the Encouraging Public Offerings Act of 2023, sponsored by Rep. Ann Wagner (MO-02), would allow all issuers to submit a confidential draft registration statement for review prior to going public and would permit any issuer to “test the waters” and gauge investor interest prior to filing.

Watch Rep. Wagner’s remarks on the House Floor in support of H.R. 2793 here or by clicking the image above.

H.R. 2812, the Middle Market IPO Cost Act, sponsored by Rep. Jim Himes (CT-04), would allow Congress to better understand the costs incurred by small and medium-sized companies associated with going public.

### |