A Reminder of the Corruption That Helped Birth the Biggest Bailout in History

Washington,

July 18, 2013

Tags:

Full Committee

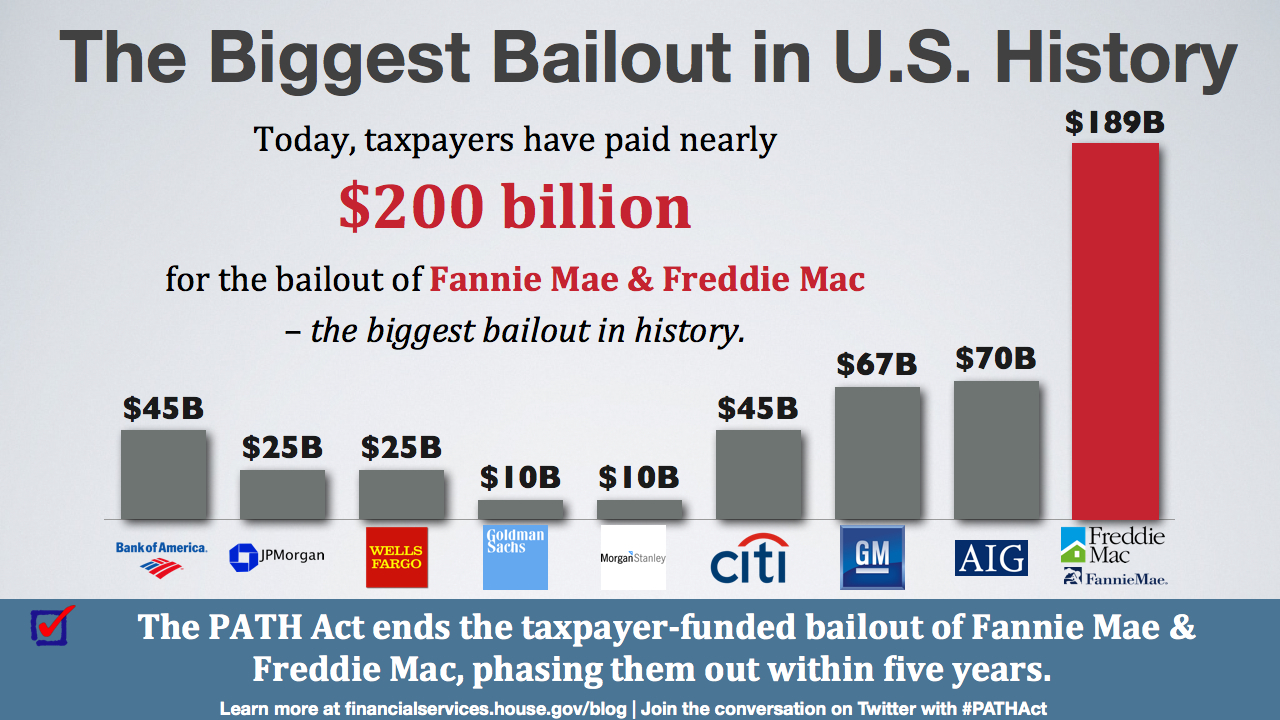

“Fannie Mae will never impose a cost on the American taxpayer…” – James A. Johnson, Chief Executive Officer of Fannie Mae, testifying before the House of Representatives, April 17, 1996 “Under the direction of James A. Johnson, Fannie Mae’s calculating and politically connected chief executive, the company capitalized on its government ties, building itself into the largest and most powerful financial institution in the world. In 2008, however, the colossus would fail, requiring hundreds of billions in taxpayer backing to keep it afloat. Fannie Mae became the quintessential example of a company whose risk taking allowed its executives to amass great wealth. But when those gambles went awry, the taxpayers had to foot the bill.” – Reckless Endangerment, published in 2011 Few issues have united Americans quite like the outrage at taxpayer-funded bailouts – and rightfully so. Hardworking taxpayers should never forget: The nearly $200 billion bailout of Fannie Mae and Freddie Mac is the biggest, costliest taxpayer-funded bailout in history.

Nor should taxpayers ever forget that Fannie and Freddie were at the epicenter of the financial crisis that destroyed millions of jobs:

While Fannie and Freddie’s role in the financial crisis is widely acknowledged, what some may have forgotten is how rank cronyism, Enron-style accounting and outright financial fraud made these GSEs so powerful and unaccountable that they were able to wreck our economy. Beginning in the late 1990s, executive pay at Fannie Mae and Freddie Mac became tied almost solely to earnings growth. So in order to trigger maximum bonus payouts for themselves, top management at the firms cooked the books to make it appear the companies were producing enough corporate earnings. And meeting the “affordable housing” goals mandated by Congress also enabled these executives “to keep their lush government perks and pay packages.” (See Reckless Endangerment, Pg. 247) When the fraud was finally detected, the Office of Federal Housing Enterprise Oversight (OFHEO) issued a scathing report calling the corporate culture created by the executives “unethical.” The report noted:

OFHEO issued a separate report detailing numerous examples of improper accounting practices at Freddie Mac and pointed to improper trades designed to mislead investors and trigger big bonuses for top executives. The report noted Freddie Mac executives had an “obsession” with earnings growth that came “at the expense of proper accounting policies and strong accounting controls.” The PATH Act (Protecting American Taxpayers and Homeowners) makes sure this never happens again. Under the PATH Act, Americans will have a sustainable housing finance system that works for the 21st century. The PATH Act includes major reforms to fix the broken GSE model that hurt our economy, including reforms that:

Unless we take bold and decisive action, Americans will never have the sustainable housing finance system they deserve. Unless we take bold and decisive action, the GSEs will remain a threat to our economy. The PATH Act is our opportunity to end the bailout, end the troubled and costly GSEs, and build a housing finance system that’s sustainable for home owners, respectful of hardworking taxpayers and built to last. |