How the U.S. GSE Model Measures Up to the Rest of the World: We’re Number... 17?

Washington,

June 11, 2013

Tags:

Full Committee

Proponents of the GSE model of housing finance often assert that the costs of that model are justified because it provides benefits that no other countries enjoy. In fact, before the collapse of the GSEs in 2008, their supporters often argued that “American housing finance is the envy of the world.” But the reality is that for all of the resources and subsidies that the GSEs directed (we would say “mis-directed”) towards housing finance, compared to the rest of the world, the U.S. ranks in the middle of the pack on any number of criteria.

Home Ownership

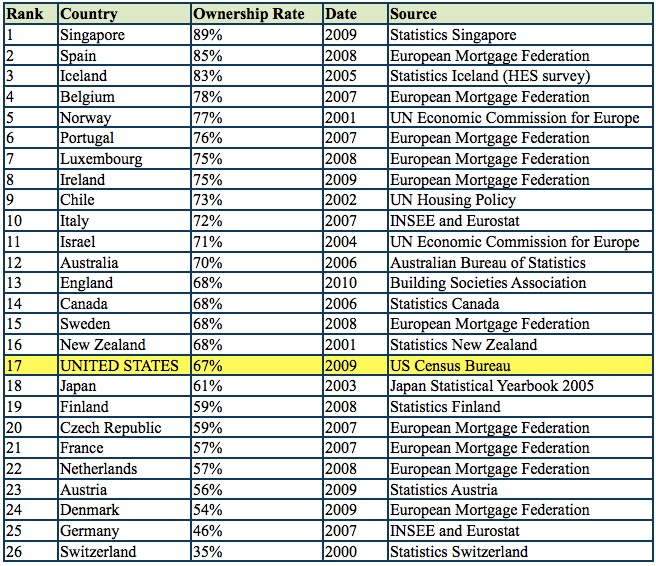

GSE proponents often argue that the GSE model has given the U.S. higher rates of home ownership than other countries that do not use the GSE model for housing finance. But the reality is that even though the U.S. has a relatively high rate of home ownership, it is not among the highest major developed countries. The U.S. home ownership rate is 65 percent, and it rates 17th in the world, after Australia, Ireland, Spain, and the United Kingdom, all of which provide far less government support for home ownership than does the United States.

Professors at the New York University’s Stern School of Business have concluded that:

Professor Dwight M. Jaffee, the Willis Booth Professor of Banking, Finance, and Real Estate at the Haas School of Business, University of California at Berkeley has compared the rates of homeownership in the U.S. to those in 15 European countries. He found that the U.S. homeownership rate—now down to 65 percent—is actually below the average rate of these 15 countries. Home ownership rates in seven European countries exceed those in the U.S. As Professor Jaffee notes, none of these European countries has any institution comparable to the GSEs. He concludes that the GSEs’ contribution to expanding homeownership rates in the U.S. has been negligible: the homeownership rate in the U.S. is 65 percent, one point higher than it was in 1990.

Mortgage Rates

GSE proponents also argue that the GSE model makes housing more affordable by lowering interest rates for borrowers. If that were true, U.S. homeowners would be borrowing at lower rates than would homeowners in other countries. Yet from 1998 to 2009, the U.S. had the sixth highest average mortgage interest rate when ranked against 15 countries in Western Europe, and mortgage interest rates in the U.S. were 22 basis points higher than the average for Western Europe. The higher rates that U.S. borrowers paid for mortgages suggests that despite the GSEs’ dominance in the U.S. housing finance system, they failed to lower mortgage rates.

Mortgage Defaults As Professor Michael Lea, Director of The Corky McMillin Center for Real Estate at San Diego State University, explains, “the housing finance systems in almost all countries performed better during the crisis than the system in the United States.” Housing prices fell more in the United States than they did in other countries, and the United States has seen more mortgage defaults than other countries.

Professor Jaffee also looked at the volatility of housing starts and home prices. He found that on these measures, European housing and mortgage markets have significantly outperformed U.S. markets. The U.S. volatility of both housing starts and home prices has exceeded the values for most Western European countries, with the U.S. ranking third out of 16 in construction volatility and fifth out of 16 in house price volatility. |