By the Numbers: President Obama’s 2014 State of the Union AddressBy the Numbers: President Obama’s 2014 State of the Union Address

Washington,

January 30, 2014

Tags:

Full Committee

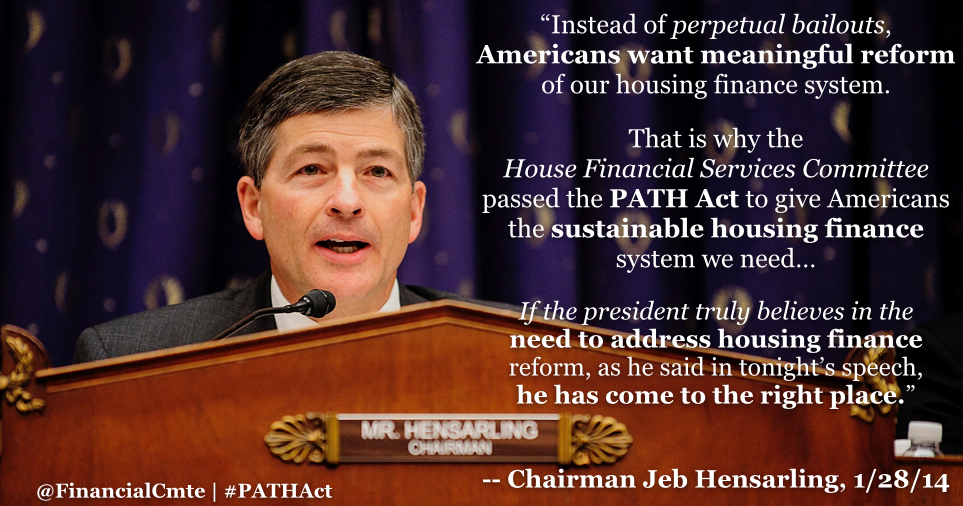

6,778 total words. 40 words devoted to housing finance reform. 0 housing finance reform proposals from the Obama administration in 5 years 1 bill in Congress that protects taxpayers from ever again having to foot the bill for a housing crisis by ending the bailout of Fannie Mae and Freddie Mac and explicitly preserves the 30-year fixed rate mortgage. That bill – the Protecting American Taxpayers and Homeowners Act, the PATH Act. “Instead of perpetual bailouts, Americans want meaningful reform of our housing finance system. That is why the House Financial Services Committee passed the PATH Act to give Americans the sustainable housing finance system we need – sustainable for homeowners so they buy homes they can actually afford to keep, sustainable to taxpayers so they will never again have to bail out Washington’s failed housing programs, and sustainable for our economy so we avoid future cycles of boom, bust and bailout. If the president truly believes in the need to address housing finance reform, as he said in tonight’s speech, he has come to the right place.” -- Chairman Jeb Hensarling, 1/28/14 |