Update: Chairman Hensarling Comments on Obama Administration’s Confirmation of $1.7 Billion Taxpayer-Funded Bailout for FHA

Back in February, Chairman Hensarling cautioned that: "If the FHA were a private financial institution, likely somebody would be fired, somebody would be fined, or the institution would find itself in receivership." Instead, he added, "it is merely, and merrily, on its way to becoming the recipient of the next great taxpayer bailout."

Echoing the chairman's warning, later that same month the Government Accountability Office (GAO) added FHA to its 'high risk' list of government programs.

We hate to say we told you so, but reports out this week now clearly show that the FHA is headed for its own billion dollar taxpayer bailout. Here's what they're saying:

Wall Street Journal | FHA, Facing Losses, Likely to Tap Treasury

Critics said the FHA's losses were a sign the government is too heavily involved in housing. "It's time to return the FHA to its traditional mission of helping first-time home buyers and those with low and moderate incomes," said Rep. Jeb Hensarling (R., Texas), chairman of the House Financial Services Committee, who said the agency had become "the nation's largest subprime lender."

The Hill | FHA may need $1 billion bailout

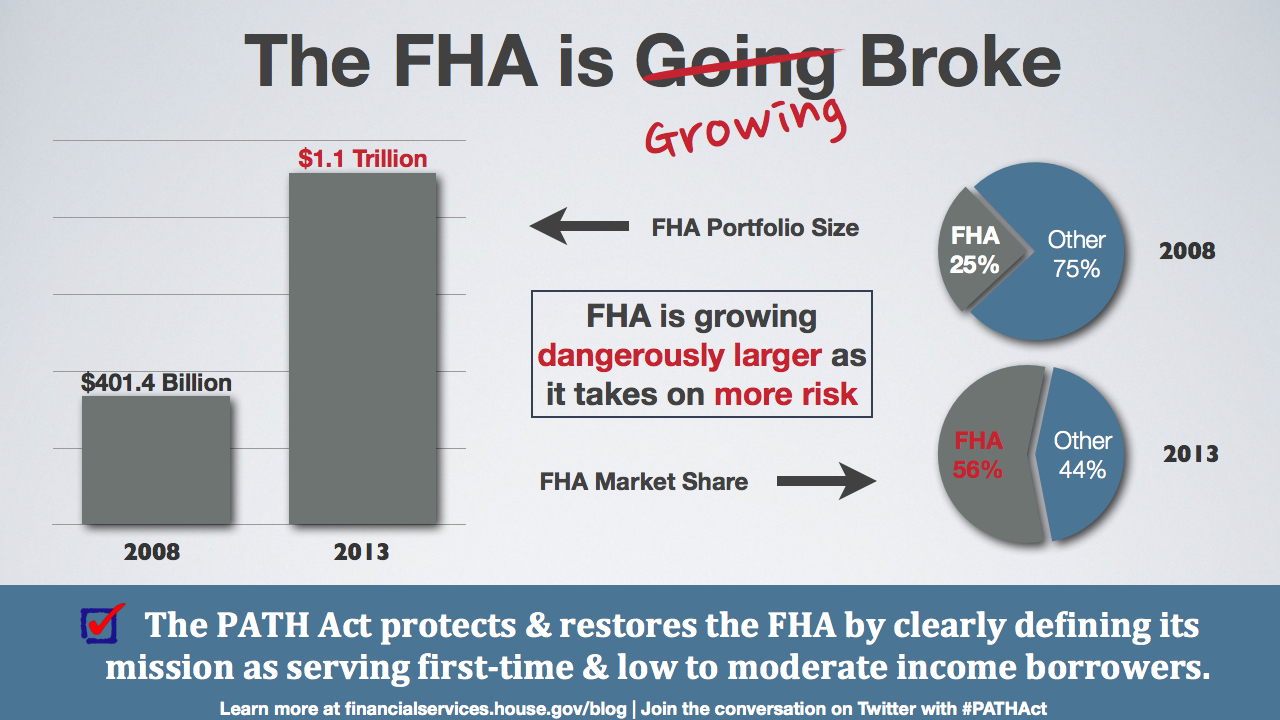

Concerns about the agency's finances increased a year ago when an independent audit found that the FHA, which has more than $1 trillion worth of loans in its portfolio, had burned through its capital reserves because of bad mortgages, and would probably need federal help.

Washington Times | Rising mortgage defaults may force FHA to request bailout from Treasury: report

...the first-ever bailout for the Depression-era mortgage insurer is a sign of the lingering stress in the housing market and stirred controversy in Congress, where conservatives have called for reforms to make the agency less vulnerable to defaults.

Bloomberg | Federal Housing Administration Said to Take Taxpayer Subsidy

The FHA’s need for aid could spur lawmakers to move more quickly to shrink the agency’s risk and its footprint in the mortgage market. Representative Jeb Hensarling, the Texas Republican who leads the House Financial Services Committee, urged swift passage of his bill to largely limit FHA coverage to first-time borrowers purchasing moderately priced homes.

How Did We Get Here?

While FHA has historically served targeted populations, like first-time homebuyers and credit-worthy low and moderate income Americans, it has strayed far from this historical and well-intentioned goal. Today, FHA can insure loans as high as $729,750. Such a home purchase is far beyond the reach of those truly earning low and moderate incomes. This mission creep has enabled FHA to crowd out its private sector competition and seize control of more than 56% of the mortgage insurance market, all the while leaving homeowners with fewer choices and exposing taxpayers to excessive risk.

America deserves better than this. Hardworking taxpayers are sick and tired of having to bail out Washington’s failed housing policies, whether it’s the nearly

$200 billion bailout of Fannie Mae and Freddie Mac or a bailout of the FHA. That's why the PATH Act includes critical reforms to right-size the FHA. These reforms include:

- Targeting FHA's mission specifically to first-time borrowers (eligible regardless of their income nationwide) and low- and moderate-income borrowers (individuals below 115 percent of area median income [AMI] nationwide, or 150 percent of AMI in high-cost areas.)

- Preserving FHA's countercyclical role, enabling it to play an expanded role during a crisis, by allowing it to insure loans to any borrower during established periods of significant credit contraction.

- Limiting taxpayer exposure by lowering FHA's maximum insurable loan limit from the current $729,750 to $625,500.

- Encouraging greater borrower equity by increasing FHA's minimum down payment requirement from 3.5 to 5 percent for all non-first-time borrowers.